The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Blog Article

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

Table of ContentsNot known Details About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Fundamentals ExplainedGetting The Mileagewise - Reconstructing Mileage Logs To WorkThe Only Guide for Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsAn Unbiased View of Mileagewise - Reconstructing Mileage LogsThe Mileagewise - Reconstructing Mileage Logs Diaries

Timeero's Quickest Distance feature recommends the shortest driving course to your staff members' location. This attribute improves efficiency and contributes to cost financial savings, making it an important asset for businesses with a mobile workforce.Such a technique to reporting and conformity simplifies the usually complicated job of taking care of mileage costs. There are numerous advantages linked with utilizing Timeero to maintain track of gas mileage.

See This Report about Mileagewise - Reconstructing Mileage Logs

These extra verification steps will maintain the Internal revenue service from having a factor to object your mileage records. With exact gas mileage monitoring innovation, your employees do not have to make harsh gas mileage quotes or also worry about gas mileage expense monitoring.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all auto expenditures (best mileage tracker app). You will require to proceed tracking mileage for work also if you're using the real expense approach. Keeping mileage documents is the only method to separate business and individual miles and supply the proof to the IRS

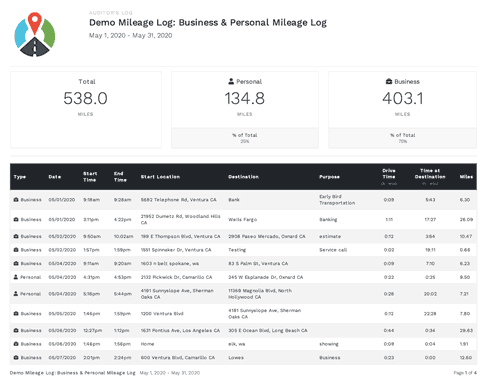

Most gas mileage trackers let you log your trips manually while computing the range and reimbursement quantities for you. Numerous additionally included real-time trip tracking - you require to begin the application at the beginning of your trip and quit it when you reach your last destination. These apps log your begin and end addresses, and time stamps, along with the total range and reimbursement quantity.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

One of the inquiries that The IRS states that automobile expenses can be considered as an "normal and required" expense in the course of operating. This includes costs such as gas, maintenance, insurance coverage, and the car's devaluation. Nonetheless, for these prices to be thought about deductible, the lorry must be utilized for company objectives.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

Start by recording your vehicle's odometer reading on January first and after that again at the end of the year. In between, carefully track all your organization journeys noting down the starting and ending readings. For each and every trip, record the area and service purpose. This can be simplified by maintaining a driving visit your auto.

This consists of the complete company mileage and complete gas mileage build-up for the year (organization + individual), journey's date, location, and objective. It's vital to record my response tasks without delay and preserve a contemporaneous driving log detailing day, miles driven, and service objective. Below's how you can improve record-keeping for audit functions: Beginning with ensuring a thorough mileage log for all business-related travel.

Examine This Report on Mileagewise - Reconstructing Mileage Logs

The real expenses approach is an alternate to the common gas mileage rate technique. As opposed to calculating your deduction based on an established price per mile, the actual expenses method enables you to deduct the real costs related to using your lorry for organization purposes - best mileage tracker app. These expenses consist of gas, upkeep, repair work, insurance, devaluation, and other associated expenses

Nevertheless, those with considerable vehicle-related expenses or one-of-a-kind problems may take advantage of the real expenses approach. Please note choosing S-corp standing can change this computation. Inevitably, your chosen method should align with your certain financial objectives and tax scenario. The Requirement Mileage Price is a procedure issued annually by the internal revenue service to figure out the insurance deductible expenses of operating an auto for service.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

(https://www.reverbnation.com/artist/mileagewisereconstructingmileagelogs)Whenever you use your cars and truck for business journeys, record the miles took a trip. At the end of the year, once again write the odometer reading. Compute your overall business miles by using your begin and end odometer analyses, and your tape-recorded service miles. Accurately tracking your precise mileage for company journeys help in corroborating your tax obligation reduction, particularly if you choose the Requirement Mileage technique.

Keeping an eye on your mileage manually can need persistance, yet bear in mind, it could conserve you cash on your tax obligations. Comply with these actions: Write down the day of each drive. Record the complete mileage driven. Think about noting your odometer readings before and after each journey. Jot down the beginning and finishing points for your trip.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company sector became the first commercial customers of GPS. By the 2000s, the delivery sector had taken on GPS to track bundles. And now almost everybody utilizes GPS to navigate. That means almost everybody can be tracked as they set about their business. And there's snag.

Report this page